27+ mortgage deduction indiana

Deductions work by reducing the amount of assessed value a taxpayer pays on a given parcel of property. Disabled veterans can claim other reductions.

Debunking 3 Myths About The Mortgage Interest Deduction

An application for these deductions must be.

. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web The deduction equals 3000 one-half of the assessed value of the property or the balance of the mortgage or contract indebtedness as of the assessment date which. If you are youll claim them.

First check the list below to see if youre eligible to claim any of the deductions. Web One of the most filed deductions is the Mortgage Deduction. Web Property tax deductions should be filed at the Auditors office.

To file for the Homestead Deduction or another deduction contact your county auditor. Web INDIANA PROPERTY TAX BENEFITS 3 DEDUCTION Indiana Code MAXIMUM AMOUNT ELIGIBILITY REQUIREMENTS APPLICATION FORM AND VERIFICATION. Web Deductions work by reducing the amount of assessed value subject to property taxation.

Web Web One of the most filed deductions is the Mortgage Deduction. Here is a link to the IN. Reducing the taxable value of the home by 3000 this deduction is for Indiana residents who.

Mortgage must be recorded before filing for exemption. Web For 2022 pay 2023 cycle 3000 is deducted from the assessed value of the property. Web Qualifying homeowners can get 50 the value of their primary residence up to 100000 deducted from property tax.

Web The Notice of Assessment of Land and Improvements Form 11 is an assessment notice that is sent to taxpayers by the county or township assessor. Please note that the property address entry field will auto populate. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

Taxpayers do not need to. Web You can file for your Homestead and Mortgage deductions online here. As you begin to type a property location addresses will appear below.

All other deductions must be filed in person because they require us to see additional. Web Indiana Code 6-11-12-178d as amended by HEA 1450 requires that if an unmarried individual receiving a homestead deduction marries and would like to continue to. If you re-finance you must refile.

Web The mortgage deduction application may alternatively be filed with the recorder in the county where the property is situated. Application for deductions must be completed and dated not later than December 31 annually. Web Mortgage Deduction 3000 Must own as of December 31.

We are located in the Courthouse Annex building at 111 American Legion Place Suite 217 in Greenfield. Web Deductions Property Tax. Web Please contact gisindygov.

Web Indiana deductions are used to reduce the amount of taxable income.

Save Money By Filing For Your Homestead And Mortgage Exemptions

Business Innovators Radio Podcast Addict

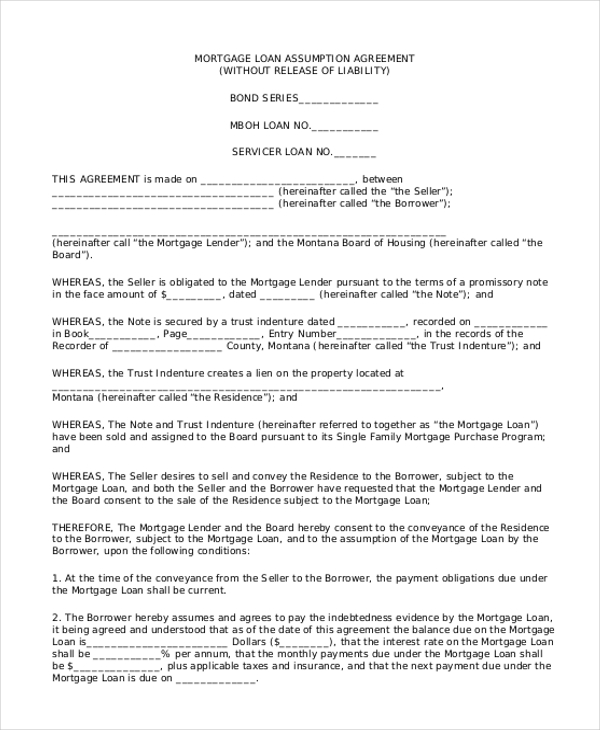

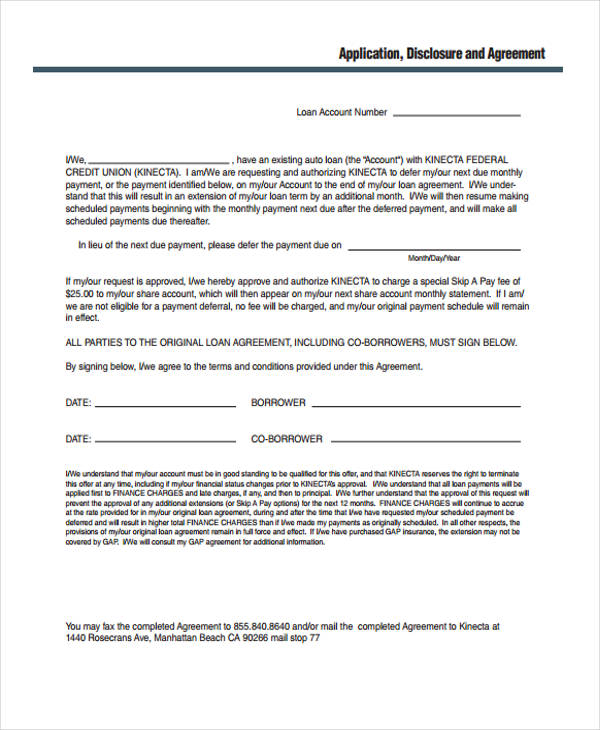

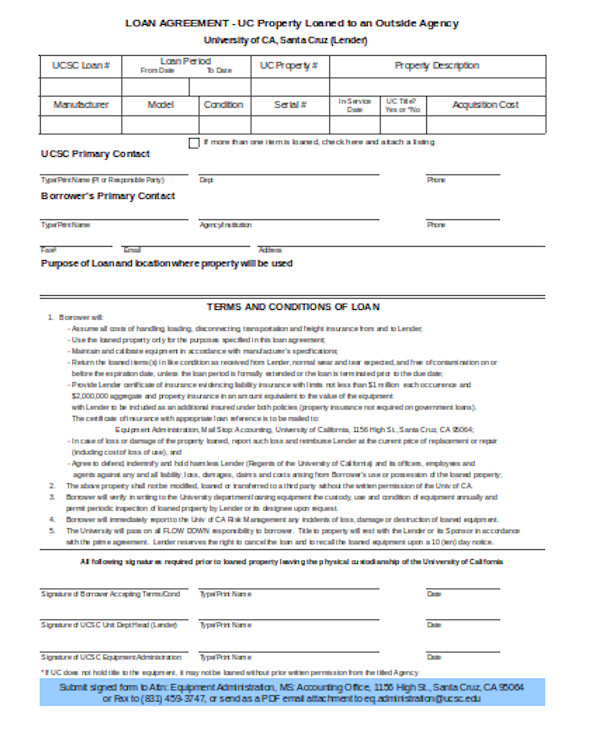

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

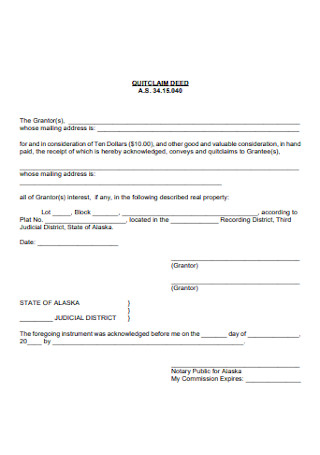

27 Sample Quit Claim Deed Forms In Pdf Ms Word

December 18 2018 The Posey County News By The Posey County News Issuu

27 Sample Quit Claim Deed Forms In Pdf Ms Word

Indiana Mortgage Deduction To End January 1 2023 Metropolitan Title

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Save Money By Filing For Your Homestead And Mortgage Exemptions

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

February 20 2013 Fort Bend Community Newspaper For Sugar Land Richmond Stafford Mo City Katy By Fort Bend Star Newspaper Issuu

Free 9 Sample Loan Agreement Forms In Ms Word Pdf Excel

Dlgf Tax Bill 101

Shopping Guide News Of Fulton County January 20 2021 By The Papers Inc Issuu

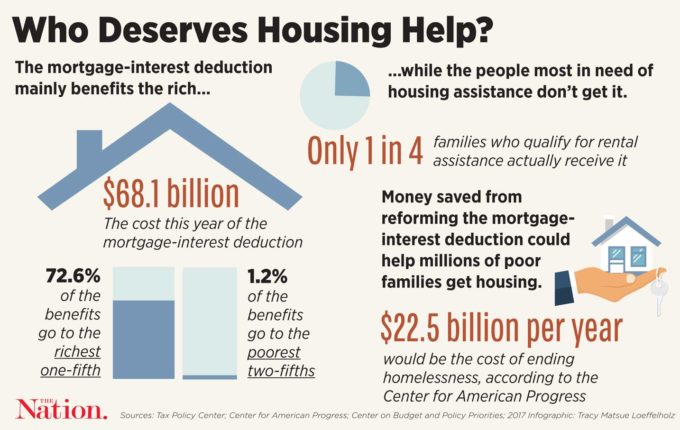

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

Save Money By Filing For Your Homestead And Mortgage Exemptions

Jodee Has A Fico Score Of 483 And Gets 9000 From First Bank Of The Palm Beaches America Loan Service